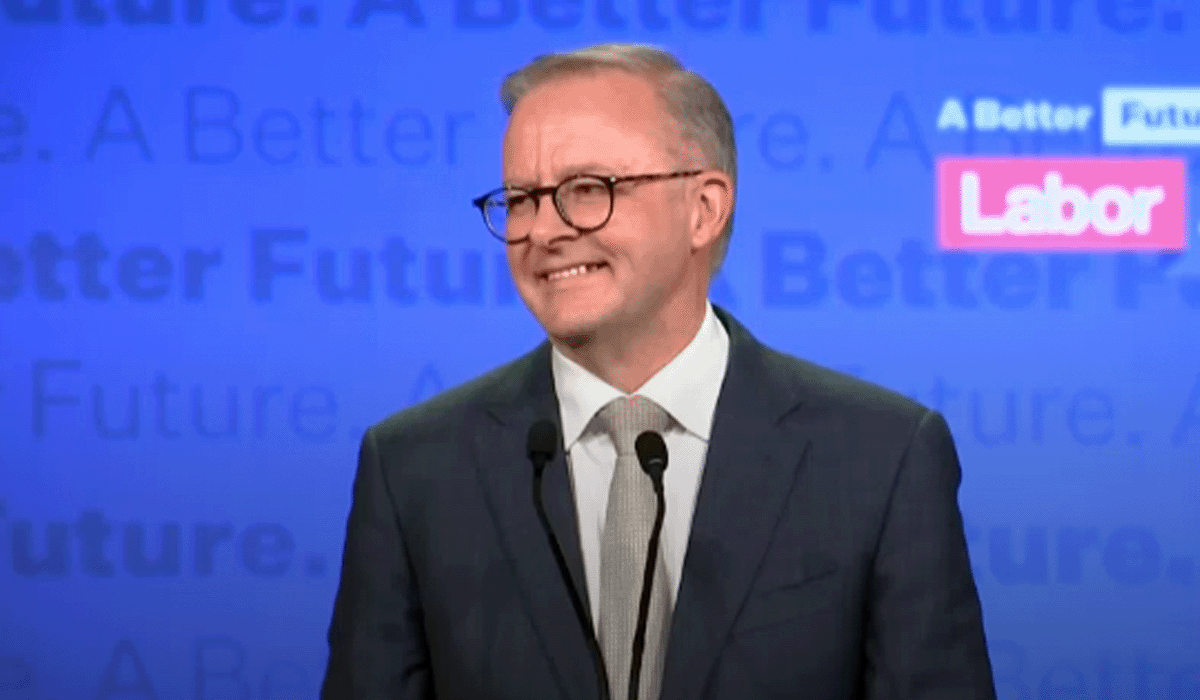

Election 2025: The state of play

The election is over. What can accountants and advisers expect?

The Labor Party has formed government, securing a majority in the House of Representatives in its own right. In the Senate, Labor is poised to gain an additional three seats in the half senate election. As such, Labor has control of the House but will continue to need some support to pass legislation through the Senate.

We look at the promises made, and the unfinished business left over from the last term.

Individuals

- Personal income tax cuts

- $1,000 instant work related expenses tax deduction

- Energy rebate extended

- Cheaper home batteries

- 5% deposit scheme for first home buyers

- 20% student debt loan reduction

Superannuation

Small business

Energy

Individuals

Personal income tax cuts

The 2025-26 federal budget introduced “modest” income tax cut for all taxpayers from 1 July 2026 and again from 1 July 2027.

The tax rate for the $18,201-$45,000 tax bracket will reduce from its current rate of 16%, to 15% from 1 July 2026, then to 14% from 2027-28 at a cost of $648m over four years. The saving from the tax cut represents a maximum of $268 in the 2026-27 year and $536 from the 2027-28 year.

Legislation enabling the tax cut passed Parliament on 26 March 2025.

$1,000 instant work related expenses tax deduction

The Government has committed to providing taxpayers who earn labour income with a $1,000 shortcut work related deduction claim on their tax return.

Taxpayers who are likely to have claims higher than $1,000 can claim in the usual way.

The simplified tax deduction is only available to those earning labour income. Those earning business or investment income only will not be able to claim.

Taxpayers will be able to claim other non-work related deductions in addition to the instant work related deduction.

The proposal does not abolish the need to lodge a tax return.

Energy rebate extended

The 2025-26 federal budget extended energy rebates. From 1 July 2025, households and small business will be eligible for a further $150 energy rebate until the end of the 2025 calendar year. The rebates will automatically apply to electricity bills in quarterly instalments.

Cheaper home batteries

The Government has committed to reducing the cost of home batteries from 1 July 2025. Through the scheme, households will be able to purchase a typical battery with a 30% discount on installed costs – saving around $4,000 on a typical battery. The initiative extends the existing Small-scale Renewable Energy Scheme.

5% deposit scheme for first home buyers

The Government has committed to a 5% deposit scheme for all Australian first home buyers. Under the scheme the Government will underwrite eligible first home buyers, enabling them to purchase a property with a 5% deposit without the need for Lenders Mortgage Insurance.

Expanding the existing first home buyer scheme, the media release says, “there will be higher property price limits and no caps on places or income, in a major expansion of the existing scheme.”

The existing Home Guarantee Scheme is limited in places and subject to income tests. The scheme is open to Australian citizens or permanent residents who have never owned property or land in Australia, or have not owned property or land in Australia in the last 10 years, and available to owner occupiers only.

20% student debt loan reduction

The Government have committed to reducing the balance of all study and training support loans by 20% from 1 July 2025. Following the passage of legislation, the Australian Taxation Office (ATO) will apply the one-off 20% reduction to an individual’s HELP or student loan account balance, before indexation is applied on 1 June 2025.

The reduction in student debt is in addition to the repayment system changes that increase the minimum repayment thresholds in 2025-26 to $67,000, with repayments only calculated on income above this level (instead of total annual income).

Superannuation

Tax on super balances above $3m

Legislation enabling the proposed Division 296 tax on superannuation balances above $3m lapsed when Parliament dissolved. The question now is whether the Government will seek to push through this reform with the support of The Greens.

Greens Senator Nick McKim has previously advocated for the Division 296 threshold to be lowered to $2m and indexed to inflation. In addition, the Senator tied his support for the tax to a “prohibition for super funds to borrow to finance investments.”

Originally intended to apply from 1 July 2025, if enacted, Division 296 will increase the headline tax rate to 30% for earnings on total superannuation balances (TSB) above $3m. The proposed calculation captures growth in TSB over the financial year allowing for contributions and withdrawals. This method captures both realised and unrealised gains, enabling negative earnings to be carried forward and offset against future years.

Small business

Extending the instant asset write-off for small business

An increase to the $1,000 instant asset write-off threshold has been a consistent feature of federal budgets by various governments as an incentive for small business investment.

The extension of the increased instant asset write-off threshold to $20,000 for the 2024-25 financial was passed by Parliament on 26 March 2025. The Government has committed to extending the $20,000 instant asset write-off threshold to 30 June 2026.

National small business strategy

The Government has released their National small business strategy for consultation. The strategy primarily addresses how different government jurisdictions work with small business and how to relieve some of the friction when dealing across government systems and requirements. Less about small business and more about how to ensure government is not making it harder.

Energy

Green Aluminium Production Credit

The Government has $2bn set aside for a new Green Aluminium Production Credit to support Australian aluminium smelters switching to renewable electricity before 2036 (there are four of them).

If you are wondering why the aluminium industry has been singled out, the reason is two-fold; aluminium is the second most used metal in the world; and according to the Institute of Energy Economics and Financial Analysis, represents about 10% of Australia’s electricity demand - Tomago Aluminium just north of Newcastle in NSW, is the largest single user of electricity in the country with electricity making up about 40% of its costs. Transition from brown to green energy is not just a consumption issue for the industry, it is a recreation of the value chain.

Under the initiative, smelters will be able to negotiate an emissions-linked credit contract payable per tonne of green aluminium produced for up to 10 years. The final credit rates will be based on individual facility circumstances and be dependent on reducing Scope 2 emissions. Scope 2 emissions are indirect greenhouse gas emissions associated with the purchase of electricity, steam, heat or cooling. They account for around 85% of emissions from aluminium smelting.

See: Aluminium to forge Australia's manufacturing future and Department of Industry, Science and Resources. New Green Aluminium Production Credit will support the transition to green metals.

Share this

You May Also Like

These Related Stories

June 2024 Round Up - Family Trust Election problem areas

What to expect from the new Government

No Comments Yet

Let us know what you think