July 2025 Round Up | GST on Cross-Border Transactions & CFC Disclosure Risks

In this month’s Tax Round-Up, we cover two key ATO focus areas.

First, we unpack the ATO’s new rulings on GST and cross-border transactions. Michael explains what the rulings clarify, and the practical steps to determine whether services provided to overseas clients are GST-free.

Then, we dive into the controlled foreign company (CFC) rules. Ann breaks down what the CFC rules are, why the ATO is concerned about disclosure errors by private groups, and practical approach dealing with these rules.

Change is a constant for the profession. The Knowledge Shop membership can help you and your team keep ahead of change with an advisers' help desk, workpaper knowledge base, quarterly PD, and more - wherever you are and however you are working. Book in a time for a tour or call the Knowledge Shop team on 1300 378 950.

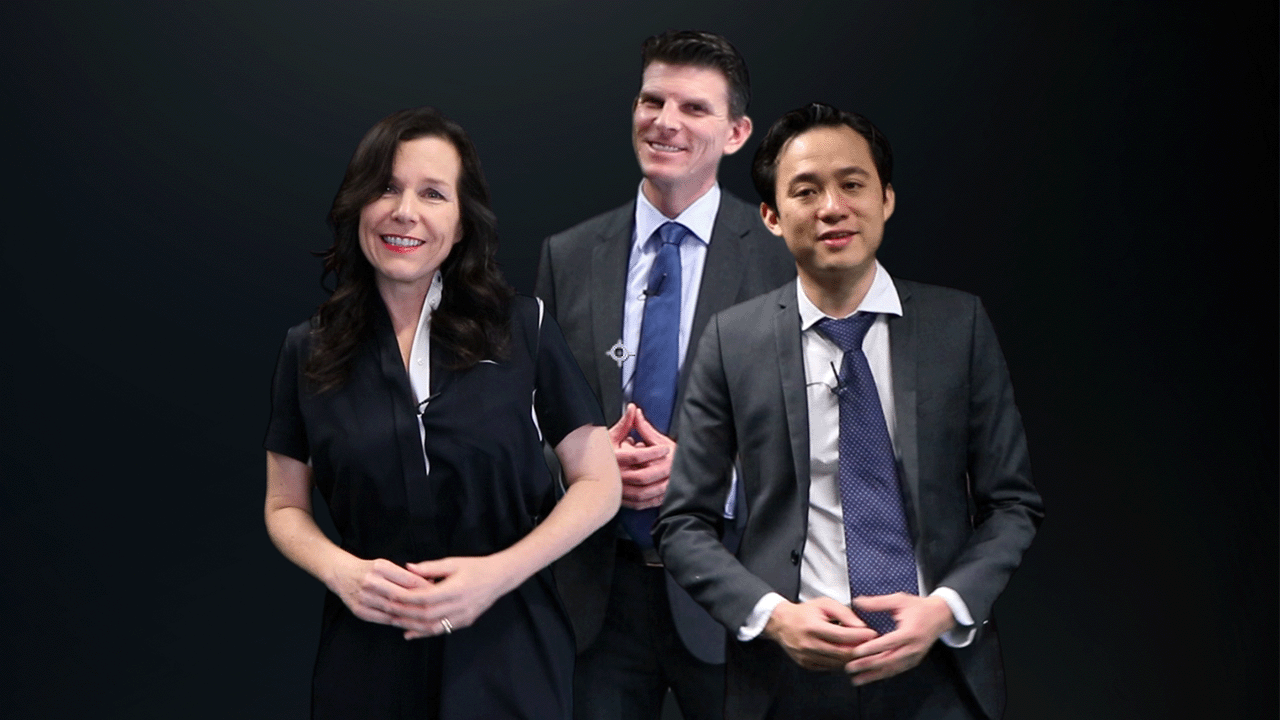

Inside this month, Ann Dai (Tax Adviser), Michael Carruthers (Tax Director) and Amy Yan (Associate Tax Director) bring you:

Individual tax returns

The ATO is reminding taxpayers with simple tax affairs that they can begin lodging individual tax returns.

The ATO has now completed the pre-fill for individual tax returns from employers, banks, government agencies and private health insurers.

Most refunds are finalised within two weeks, and the process can be sped up if the ATO is contacted.

Taxpayers have until 31 October to lodge their tax return or to get on the books of a registered tax agent.

Reference:

Common CFC errors for private groups

The ATO has noticed a high error rate for privately owned and wealthy groups in their controlled foreign company (CFC) disclosures. Private group compliance continues to be a key focus of the Tax Avoidance Taskforce.

Australian resident taxpayers must apply the CFC provisions if they have a controlling interest in a foreign company. The CFC rules will sometimes operate so that a resident taxpayer needs to include some or all of the foreign company’s income in their Australian tax return, even if no dividends have been paid by the company. Australian taxpayers with interests in CFCs need to disclose all CFCs, and relevant income amounts in tax returns and the international dealings schedule (IDS).

The ATO has flagged common errors:

- Under-reporting of CFC attributable income in tax returns, often from errors in applying the active income test, or from failing to recognise tainted income

- Deemed dividends from unlisted country CFCs omitted from the taxpayer’s assessable income

- Incorrect IDS disclosures, including completely overlooking CFCs where there is associate-inclusive control

- Inaccurate reporting of CFC gross revenue and the number of CFCs acquired and disposed of.

The ATO recommends following these tips:

- Review the ATO’s Controlled foreign company page for the Private Wealth International Program.

- Discuss the CFC provisions with clients and encourage clients to keep you in the loop across all business developments, even if they’re small.

- Take care if the group is growing rapidly in size and complexity.

- Amend any previously lodged tax returns if you discover an error, to avoid penalties and interest.

Reference:

GST on supplies made to non-residents but provided to another entity in Australia

The ATO has issued GSTR 2025/1 which looks at the operation of section 38-190(3) GST Act. The ruling was enacted in response to amendments from the Tax and Superannuation Laws Amendment (2016 Measures No 1) Act 2016, and replaces GSTR 2005/6, which is now withdrawn.

In broad terms, item 2 of the table in section 38-190 allows a supply of something other than goods or real property (eg, services) to be GST-free where the supply is made to a non-resident who is not in Australia at the relevant time and either:

- The supply is not performed on goods situated in Australia and is not directly connected with real property in Australia; or

- The non-resident acquires the services in the course of carrying on an enterprise but is not registered or required to be registered for GST in Australia.

However, in some cases the supply cannot be GST-free under this item if the arrangement or agreement requires the supplier to actually make a supply to an entity in Australia, although there are some exceptions to this.

The ruling deals specifically with the issue of whether the GST-free treatment is lost because the supply needs to be made to an entity in Australia, including consideration of the exceptions that can sometimes apply.

The new ruling is broadly consistent with the previous ruling, and the content is substantially the same, with some changes to the structure of the ruling and examples.

Reference:

GST and whether the effective use or enjoyment is outside Australia

The ATO has issued GSTR 2025/2 which examines the circumstances in which the effective use or enjoyment of a supply takes place outside Australia for the purposes of paragraph (b) of table item 3 of subsection 38-190(1) GST Act.

The ruling was enacted in response to amendments from the Tax and Superannuation Laws Amendment (2016 Measures No 1) Act 2016, and replaces GSTR 2007/2, which is now withdrawn.

Item 3 of the table in section 38-190 ensures that a supply of something other than goods or real property (eg, services) can be GST-free if:

- The supply is made to a recipient who is not in Australia when the supply is done;

- The effective use and enjoyment of the supply takes place outside Australia; and

- The supply is not performed on goods situated in Australia and is not directly connected with real property in Australia.

The ruling looks at:

- How to determine when effective use or enjoyment of a supply takes place, or does not take place, outside Australia;

- What apportionment is required if effective use or enjoyment of the supply takes place partly outside Australia;

- The operation of subsection 38-190(4), which extends the application of the rules by treating certain supplies as though they are made to a recipient who is not in Australia; and

- The application of item 3 to certain supplies that are connected with Australia solely because of paragraph 9-25(5)(d).

Reference:

Share this

You May Also Like

These Related Stories

September 2025 Round Up | ATO 2025-26 focus areas and a warning on the deadline for claiming GST credits

Sept 2022 Round Up - Confusion over CGT and non-residents

No Comments Yet

Let us know what you think