Legislation creating an ‘experience pathway’ for financial advisers has passed Parliament. But what does that really mean to existing financial advisers?

The education pathway for experienced financial advisers recognises industry experience and removes the requirement to complete an approved university degree by 1 January 2026. Up until this point, all advisers had to pass the exam and have an approved qualification to remain in the profession after this date.

The new pathway for experienced advisers means that an eligible adviser with 10 years of experience will not have to have an approved qualification (yes, you still need to pass the financial services exam). A relief to many non-degree qualified advisers who did not want to have to complete a full university degree to prove they can do the job.

How can I access the ‘experience pathway’?

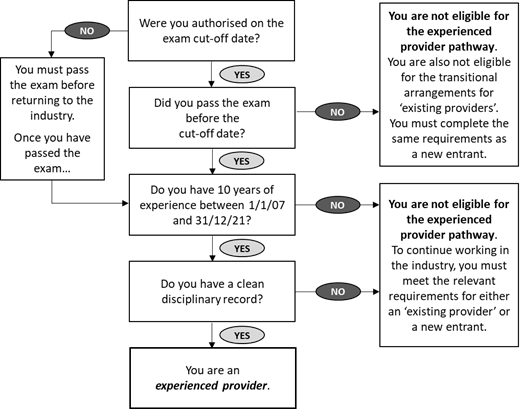

You can access the experience pathway if you:

- were authorised to provide personal advice to retail clients on the exam cut-off date (1 January 2022. Note that advisers who failed the exam twice had until 1 October 2022); and

- have provided this advice for a minimum of 10 years between 1 Jan 2007 and 31 December 2021; and

- have a clean disciplinary record.

So, what does that all mean?

If you were authorised to provide financial advice to retail clients on the exam cut-off date, then you meet the first criteria.

To meet the 10 year experience requirement, you have to of had 10 years of experience between 1 January 2007 and 31 December 2021. The 10 years of experience does not need to have been consecutive, for example you might have taken a few breaks for parental leave. As long as your cumulative total across that period is 10 years or more then you will meet the criteria. The requirement does not distinguish between part time and full time, as long as you were providing advice to retail clients for a cumulative total of 10 years then you will meet this criteria.

A clean disciplinary body means that you have not been banned, disqualified and have never given an enforceable undertaking to ASIC.

Explanatory memorandum

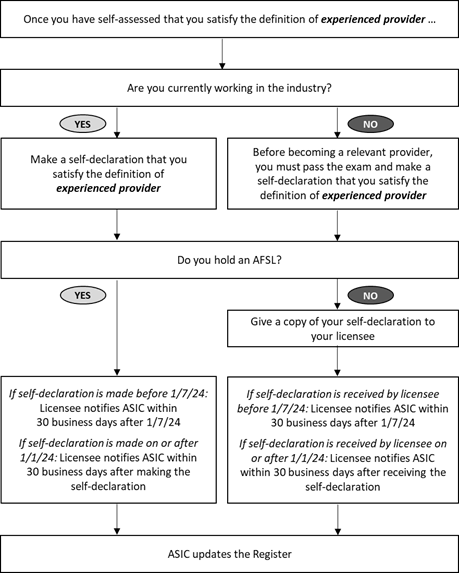

Formalising your access to the pathway

- Self-declaration. The education pathway is self-assessed and you will need to make a self-declaration confirming that you have met all the criteria to be an experienced provider. This declaration needs to be made prior to the end of the transitional period for the education requirements on 1 January 2026.

- Provide the self-declaration to your AFSL. You will need to ensure that the self-declaration is provided to your AFSL before 1 January 2026. If you work with multiple AFSLs or move AFSLs, each AFSL you work with will need a copy. It is possible that your AFSL will require evidence to satisfy themselves that the self-declaration is valid.

- AFSL lodges notice with ASIC. Once received, the AFSL will need to lodge a notice with ASIC. These notices are not required to be lodged with ASIC until 1 July 2024. After that point the AFSL has 30 days of receipt of the declaration to lodge the notice.

- ASIC will update the financial advisers register.

Explanatory memorandum

I left the industry but want to return

If you left the industry and want to return using the experience pathway, the key issue is whether you were authorised before the financial services exam cut-off date.

Authorised to provide personal advice to retail clients on 1 January 2022

- If you were authorised and you passed the financial services exam, then you can re-enter the industry utilising the experience pathway (assuming you meet the eligibility criteria).

- If you were authorised and did not pass the financial services exam, the experience pathway is not open to you and you will need to re-enter the profession as a new entrant. That is, pass the exam and complete an approved qualification.

Was not authorised to provide personal advice to retail clients on 1 January 2022

- If you were not authorised on 1 January 2022, you can re-enter the industry utilising the experience pathway (assuming you meet the eligibility criteria) but only once you have passed the exam.

We will keep you up to date about the details as they come to hand!

Comments (2)